Taxonomy regulation: An Overview of the Reporting Obligations

While the Taxonomy Regulation[1] establishes a classification system for determining whether an economic activity is environmentally sustainable, it also introduces obligations on certain types of entities to report on the Taxonomy alignment of their activities or the financial products that they offer.

Companies required to prepare non-financial/sustainability statements – Accounting Directive

The first set of disclosure requirements apply to those companies that are required to prepare non-financial statements in accordance with the Accounting Directive[2], as amended by the Non-Financial Reporting Directive (NFRD)[3]. These requirements will eventually apply to all companies that are required to report under the Corporate Sustainability Reporting Directive (CSRD)[4]. This will significantly increase the number of companies that will be required to report on the extent to which their activities are taxonomy aligned over the next few years. While these disclosure obligations already apply[5] to those entities that are required to prepare sustainability statements relating to their 2024 financial year to comply with the CSRD sustainability reporting requirements, those first required to report in respect of the 2025 financial year will not previously have had to consider these taxonomy disclosure requirements.

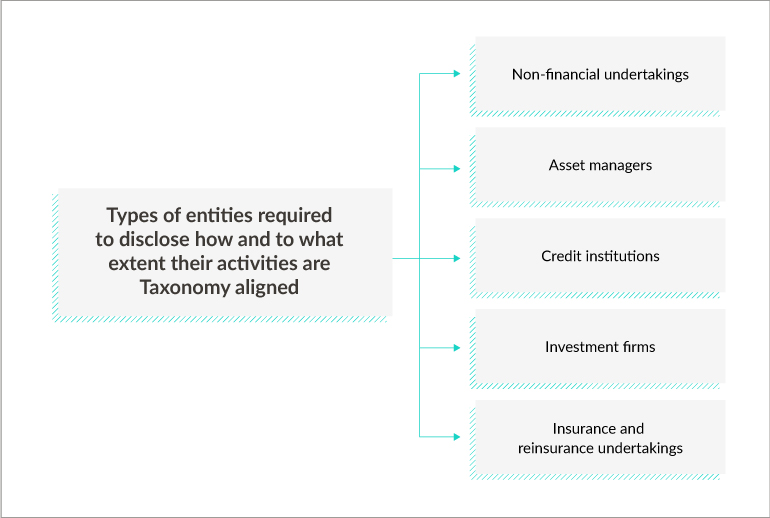

The high-level detail of these requirements is set out in Article 8 of the Taxonomy Regulation which states that companies must report on how and to what extent their activities are associated with economic activities that qualify as taxonomy aligned. For non-financial undertakings, further information on the detail to be disclosed is set out within the Taxonomy Regulation itself. Such companies are required to disclose the proportion of their turnover derived from products or services associated with economic activities that qualify as taxonomy aligned as well as the proportion of their CapEx and OpEx related to assets or processes associated with economic activities that qualify as taxonomy aligned. The European Commission was tasked with providing companies with additional information on how to calculate and present the information that needs to be reported to comply with these disclosure obligations. This information is contained within a delegated regulation[6] known as the Disclosures Delegated Act or Article 8 Delegated Act. In addition to providing additional information to non-financial undertakings, this delegated regulation also sets out the information to be provided by different types of financial undertakings based on the type of business such companies are involved in. See Figure 1 for the categories of financial undertakings for which there are separate disclosure obligations.

Figure 1 – Types of entities with separate disclosure requirements

While turnover, CapEx and OpEx are the three key performance indicators (KPI) for non-financial undertakings, these are considered to be irrelevant for assessing the environmental sustainability of the activities of financial undertakings such as lending, insurance, and investment activities.

Asset managers are required to disclose the proportion of investments they have made in taxonomy aligned activities as a portion of their assets under management. The proportion of taxonomy aligned investments needs to be calculated as a proportion of the taxonomy aligned economic activities of its investee companies. Annexes III and IV set out how asset managers should calculate the KPI and the standard template that should be used for this disclosure.

While the disclosure requirements for credit institutions are complex given the types of services that credit institutions can offer in addition to the provision of financing to companies, the main KPI for credit institutions is the green asset ratio or GAR which shows the proportion of exposures related to taxonomy aligned activities compared to its total assets. The GAR should relate to a credit institution's lending and investment business as well as to its equity holdings so that it reflects the extent to which that credit institution finances taxonomy aligned activities. Annex V sets out how credit institutions should calculate the GAR in respect of its different exposures as well as other KPI that need to be considered while Annex VI contains the various standard templates that should be used for this disclosure.

Investment firms are required to disclose the investments that they have made in taxonomy aligned activities with this disclosure to cover its dealing activities whether as principal or on behalf of clients as well as its investment services and activities. The KPI used will depend on the type of activity being undertaken. For example, the KPI of an investment firm's services and activities on behalf of all its clients should be based on the revenue in the form of fees, commissions, and other monetary benefits that the investment firm generates from its investment services and activities carried out for its clients. Annexes VII and VIII set out how investment firms should calculate the various KPI and the various standard templates that should be used for this disclosure.

Insurance and reinsurance undertakings are required to disclose KPI relating to their investment activities and for non-life (re)insurers, KPI relating to their underwriting activities to show the extent to which those activities are aligned with the taxonomy. Annexes IX and X set out how (re)insurers should calculate the KPI related to investments and if relevant related to underwriting activities and the various standard templates that should be used for this disclosure.

Financial Products – SFDR

The second set of disclosure requirements apply in respect of financial products falling within scope of the Sustainable Finance Disclosures Regulation (SFDR). [7]Articles 5, 6 and 7 of the Taxonomy Regulation detail the information that needs to be disclosed in the pre-contractual disclosures and periodic reports of such financial products. The type of information to be report depends on whether the specific financial product promotes environmental or social characteristics or has sustainable investment as its objective. If neither of these criteria are met for the relevant financial product, then it is necessary to make it clear that the investments underlying the product do not take into account the EU criteria for environmentally sustainable economic activities. In other words, the underlying investments are not taxonomy aligned.

For those financial products that promote environmental or social characteristics or have sustainable investment as their objective, further analysis is required to determine what, if any, additional disclosure needs to be included in the relevant pre-contractual disclosures and periodic reports. In practice the template pre-contractual disclosures and periodic report annexes under the SFDR Level 2 Regulation[8] enable financial market participants such as asset managers, insurers, and pension providers to disclose the percentage of taxonomy alignment of the financial products they make available.

While these disclosure obligations applied from 1 January 2023, the percentage of taxonomy alignment currently being disclosed by financial market participants remains low. One of the main reasons for this is the lack of data in respect of the underlying investments. This should change in the coming years as more companies are required to report on the taxonomy alignment of their activities in order to comply with the disclosure requirements under Article 8 of the Taxonomy Regulation.

Conclusion

For those required to comply with the first set of disclosure requirements set out above or looking to understand the Taxonomy Regulation more generally, the European Commission has published a series of online tools[9] to enable users to better understand the taxonomy requirements. One of these tools, the EU taxonomy calculator[10], provides a step-by-step guide for non-financial undertakings on how to complete the reporting template although it should be noted that this calculator focuses only on climate change mitigation.

In addition, the European Commission has published notices on the interpretation and implementation of certain legal provisions of the Disclosures Delegated Act on the reporting of taxonomy-eligible and taxonomy-aligned economic activities and assets[11] and an EU Taxonomy User Guide[12] which provides high level guidance on taxonomy alignment.

For more information in relation to this topic, please contact Jill Shaw, ESG & Sustainability Lead or visit our ESG & Sustainability hub.