Page Contents

Key contacts

Related areas

Pillar Two is now in force in Ireland, with the effect that a 15% minimum effective corporation tax rate applies to large corporate groups and standalone entities with a turnover of €750m or more, for accounting periods commencing on or after 31 December 2023.

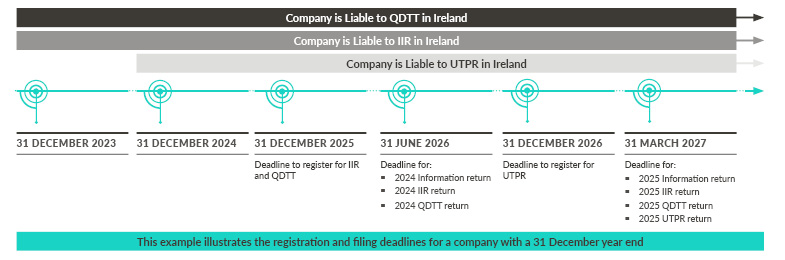

Ireland has introduced the Income Inclusion Rule (IIR) and Qualified Domestic Top Up Tax (QDTT) with effect for accounting periods commencing on or after 31 December 2023, while, subject to some exceptions, the Undertaxed Payment Rule (UTPR) will take effect for accounting periods commencing on or after 31 December 2024. The UTPR will apply for periods commencing on or after 31 December 2023 where the ultimate parent entity (UPE) of the group is located in Malta, Estonia, Lithuania, Latvia or Slovakia and is delayed until 31 December 2026 in respect of a UPE jurisdiction with a statutory corporation tax rate of at least 20%.

The Pillar Two rules will have no effect for groups below the €750m threshold and those groups will continue to be subject to the existing Irish corporation tax rules, including the 12.5% corporation tax rate.

Those groups that are subject to the Pillar Two rules will have a number of additional filing obligations.

This insight sets out the registration obligations of groups, what additional returns must be filed, and when they are due.

Registering for Pillar Two Taxes

Any Irish entities that are subject to the IIR, QDTT and/or UTPR must register with Revenue in respect of each applicable tax within 12 months of the end of the first fiscal year in which the entity is subject to that tax. Bear in mind that within a corporate group, there may be multiple entities with liabilities to each of the different taxes, depending on the group structure.

For example, a company with a 31 December year end that will be liable to the IIR and QDTT for 2024, must register for these taxes by 31 December 2025. If that company is then liable to the UTPR in 2025, it will need to register for the UTPR 31 December 2026.

When registering for any Pillar Two taxes with Revenue, the entity must provide:

Once registered, entities must notify Revenue of any change in the information provided to Revenue, including if the entity ceases to be subject to the relevant tax, within 12 months of the end of the fiscal year in which the change occurs.

Failure to comply with these registration requirements, or failure to notify Revenue of a relevant change, gives rise to a potential penalty of €10,000. However, for fiscal years beginning on or before 31 December 2026, no penalties will be imposed on entities that take reasonable care to ensure correct application of the legislation.

Recommendations in relation to registering for Pillar Two taxe

The Top-up Tax Information Return

Any Irish entity that is within scope of Pillar Two must submit a top-up tax information return to Revenue within 15 months from the end of its fiscal year. This deadline is extended to 18 months from the end of the entity’s first year within the scope of Pillar Two. For example, for a company with a 31 December year end that is subject to any Pillar Two tax in 2024, its first information return will be due on 30 June 2026.

The information return is in the same form as the OECD’s standardised GloBE Information Return (GIR). It requires substantial information about the whole group, including:

Where a group has multiple entities in Ireland, it can appoint one entity as its designated local entity, which will file the GIR on behalf of all group entities in Ireland.

The requirement to file the GIR is waived in the following two scenarios and, instead, entities will file a more limited information return:

Recommendations in relation to the top-up tax information return

The Pillar Two Tax Returns

The filing deadline for the IIR, QDTT and UTPR returns is 15 months from the end of the fiscal year. For the first year in which an entity is subject to any of the Pillar Two taxes in Ireland, the deadline is extended to 18 months from the end of the fiscal year.

For example, a company with a 31 December year end is liable to QDTT in Ireland in 2024. Its QDTT return will be due on 30 June 2026. If the company becomes liable to UTPR in 2025, it will have to file a QDTT return and a UTPR return by 31 March 2027, i.e. it does not get the filing extension in respect of the UTPR return because, although it was the first year it was liable to UTPR, it was liable to QDTT in the previous year.

If a company that was not previously liable to any Pillar Two taxes joins the group in 2026, it will be able to avail of the filing extension for its first year filing(s), notwithstanding other group members have previously been subject to Pillar Two taxes.

Appointing a Group Filer - QDTT and UTPR

In respect of the QDTT and the UTPR, one group member can be appointed to file the relevant return on behalf of all Irish group members. The group filer will be primarily liable for the relevant tax in respect of all the Irish group members. However, if the group filer fails to pay the tax, Revenue can serve a notice on another group member, requiring it to pay the outstanding amount (including interest, surcharges and penalties), within 30 days.

Where a group filer is appointed, it must represent all Irish members of that group. While having a group filer may ease the administrative burden of these taxes, it may add complexity where a group member leaves the group, so careful consideration is needed before electing into a group.

Recommendations in relation to the Pillar Two tax returns

You should also be aware…

Date of Payment of Pillar Two Taxes

The Pillar Two taxes are due on the relevant filing deadline (i.e. 15 months from the fiscal year end, or 18 months where it is the first year in which the entity is liable to Pillar Two taxes).

Late Return Surcharge and Late Interest

The surcharge for late returns is significantly higher than for corporation tax returns. Where the return is less than two months late, a 5% surcharge (capped at €50,000) will apply; after that a 10% surcharge (capped at €200,000) will apply.

Additionally, late interest will apply at a daily rate of 0.0219% from the due date on any unpaid amount.

Obligation to keep records

Adequate records must be kept for a period of 6 years from the end of the fiscal year to which they relate. Failure to comply with this requirement will result in a penalty of €10,000.

Penalties

Where an entity fails to file an information return (regardless of whether it has appointed a designated local filer) or where it has appointed a designated filing entity in another jurisdiction, a notification of filer, by the return date, it will be subject to a penalty of €10,000 per month (up to a maximum of €480,000). Failure to file an IIR, UTPR or QDTT return by the return date will also give rise to a penalty of €10,000.

However, as referenced above, for fiscal years beginning on or before 31 December 2026, no penalties will be imposed on entities that take reasonable care to ensure correct application of the legislation. Surcharges for late returns and interest on overdue amounts will nonetheless apply.

Key contacts

For more information on this, please contact Paul Fahy, Partner, James Somerville, Partner, Amelia O’Beirne, Partner, Dearbhla O'Gorman, Senior Associate, Cian Ryan, Solicitor, or any member of A&L Goodbody's Tax Department.

Date published: 17 April 2024