Miscellaneous Provisions Bill 2019

Business leaders are being continuously advised to "prepare for Brexit". But how do you prepare with no rule book or end game? That is now changing to some extent.

The Irish Government has published the General Scheme for its Brexit legislation – the "Miscellaneous Provisions (Withdrawal of the United Kingdom from the European Union on 29 March 2019) Bill 2019".

This General Scheme is the first step in the legislative process. The next steps are likely to be a Bill, a debate in the Irish parliament (the Oireachtas) followed by enactment as an Act of the Oireachtas.

The Irish legislation on Brexit is expected to expand to deal with other areas and sectors. At this stage, some of the provisions are quite technical but it is expected to cover more areas in the coming weeks.

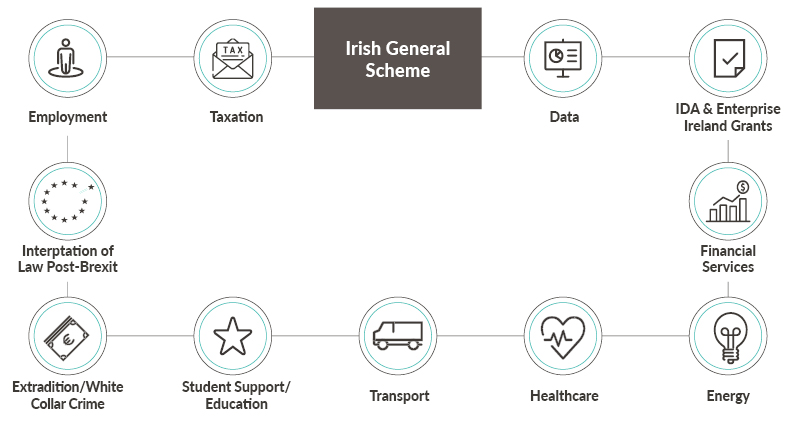

At present, the Irish General Scheme deals with the following topics:

Lawyers from our Dublin, Belfast and London offices have summarised the key elements below of this critical legislation. Please contact our experts for in-depth interpretation of the legislation as it relates to your business.

Social Welfare

One of the four freedoms enjoyed by EU citizens is the free movement of workers across the EU. Part 11 of the General Scheme relates to Employment in the context of social welfare, and is of key interest to companies with cross-border employees (particularly between UK and Ireland) and cross-border employees themselves. Part 11 refers to a number of amendments to Ireland's Social Welfare (Consolidation) Act 2005, the most material relating to: i) Continued eligibility for benefits, ii) Prohibition on double recovery and iii) data transfer.

For more information please contact Michael Doyle, Employment partner.

Protection of Employees

Part 12 of the General Scheme relates to Employment and particularly the Protection of Employees. It is therefore of most interest to Irish employers, cross-border employers and employees, and insolvency practitioners. The Protection of Employees (Employers’ Insolvency) Act 1984 protects employees in the event of the insolvency of their employer. Established under the Act, the Insolvency Payments Scheme (the IP Scheme) protects pay-related entitlements owed to employees where their employer has been made insolvent. The overall purpose of Part 12 is to amend the 1984 Act to ensure that employees of UK employers who are employed or habitually employed in Ireland can continue to be covered by the IP Scheme where their employer has been made insolvent under the laws of the UK.

For more information please contact Noeleen Meehan, Employment Associate.

Immigration

Part 15 of the General Scheme relates to Employment in the context of immigration. This Part of the General Scheme is of most interest to Irish employers, cross-border employers and employees as it looks to amend the Immigration Act 1999 and the Immigration Act 2003 so that these Acts are in full compliance with the principle of non-refoulement.

For more information please contact Duncan Inverarity, Head of Employment.

Taxation is addressed within Part 6 of the General Scheme. There are a significant number of provisions in Ireland's Taxes Acts that limit certain tax reliefs or other tax advantageous treatment to activities carried out in entities resident in EU or European Economic Area Member States. We have reviewed the fundamental impact of the proposed measures on Irish corporate taxpayers, insurers, Irish individual taxpayers, Irish investors, UK investors, pension schemes and UK university students and their parents.

For more information please contact James Somerville, Tax partner

Parts 16 and 17 of the of the General Scheme deal with amendments to the Data Protection Act 2018 to ensure immigration data can continue to be exchanged freely with the UK. It is notable that the General Scheme does not provide for a method for legally transferring personal data (other than immigration data and data relating to social welfare schemes) to the UK post-Brexit. In the event of a no-deal Brexit, the UK will become a third country and any data transfers from the EEA to the UK will be restricted unless a transfer mechanism under Chapter V of the GDPR is put in place. To prepare for a no-deal Brexit, we have identified a number of steps that companies should take now.

For more information please contact John Whelan, Commercial & Technology partner.

IDA and Enterprise Ireland Grants

If enacted, the provisions of the General Scheme will enable Enterprise Ireland (EI) to increase the level of support for Irish businesses. This is particularly relevant for Irish business owners and investors and Irish-based businesses that may need Irish Government aid as a result of Brexit.

For more information please contact Sheena Doggett, Corporate and M&A partner.

Settlement Finality (Third Country Provisions)

Part 7 of the General Scheme addresses a very specific (but fundamental) element of Irish financial services infrastructure. It proposes to support the EU proposal by conferring power on the Minister for Finance to designate third country systems (such as CREST) under Irish law as a designated system under the Settlement Finality Directive and related regulations. This is of relevance to Irish, UK and other investors trading Irish equities, bonds and units in exchange-traded funds.

For more information please contact Seamus O'Croinin, Finance partner.

Part 8 of the General Scheme outlines the Department's proposals for a temporary three-year run-off regime for UK insurers and insurance intermediaries, during which time no new insurance contracts can be written, but existing contracts can be serviced. This is of most relevance to UK insurers and insurance intermediaries (including those considering moving to Ireland because of Brexit) and Irish insurers and insurance intermediaries.

For more information please contact Laura Mulleady, Insurance partner.

Part 2 of the General Scheme covers the legal framework facilitating continued access to emergency, routine and planned healthcare in the UK and Ireland. In a no-deal Brexit, this part of the General Scheme would enable necessary healthcare arrangements including reimbursement arrangements to be maintained between Ireland and the UK. This is of key interest to healthcare providers and health Insurers in Ireland and the UK as well as pharmaceutical companies in Ireland and the UK.

For more information please contact Cliona Christle, Healthcare partner or Anna-Marie Curran, Procurement partner.

Part 4 of the General Scheme introduces an amendment to the Electricity Regulation Act 1999 to give the Commission for Regulation of Utilities a very wide ranging power to modify the conditions of statutory licences issued to electricity market participants in the context of a no-deal Brexit. This is of particular interest to participants in the Energy Sector in Ireland, Northern Ireland and the UK generally

For more information please contact Ross Moore, Energy & Natural Resources partner.

Railways, Buses and Coach Services

The General Scheme suggests that the Bill will extend this recognition to railways established in a third country with which Ireland has a bilateral agreement. In addition the General Scheme suggests that the Bill will provide for authorising 'third country services' under bilateral agreements between Ireland and countries that have no necessary agreement with the EU.

We summarise how the Brexit General Scheme affects the regulation of bus companies, railways, coach services and customers in Ireland and Northern Ireland.

Student Support/Education

Under the Student Support Act 2011, Student Universal Support Ireland (SUSI, which is an operation of the City of Dublin Education and Training Board) awards higher education grants to students. We summarise the key provisions included for educational institutions and students in Ireland and Northern Ireland.

For more information please contact Eamonn Conlon, A&L Goodbody partner.

The European Arrest Warrant (EAW) scheme is the basis for current extradition arrangements between the UK and Ireland. If the UK leaves the EU in a no-deal scenario, it will no longer be party to the EAW. The General Scheme proposes that in the event of a no-deal Brexit, Ireland will both amend and pass secondary legislation under Ireland's Extradition Act 1965. This is relevant to any companies interested in white collar crime and extradition.

For more information please contact Kenan Furlong, White Collar Crime partner.

One of shortest and most technical parts of the proposed legislation relates to interpretation of Irish legislation post-Brexit. Despite its brevity, Part 13 could have an impact across many businesses - particularly regulated businesses and those involved in international trade. Part 13 of the General Scheme would apply if the UK enters a "transition" period after 29 March 2019.

For more information please contact Dr. Vincent Power, EU, Competition and Procurement partner.